This week, the total inventory of construction steel continued to decline. The total rebar inventory stood at 5.1853 million mt, down 7.51% WoW. The total wire rod inventory was 1.0607 million mt, down 3.52% WoW. On the supply side, blast furnace steel mills generally maintained a profit level of over 100 yuan per mt this week, and their production willingness remained moderate. According to the SMM survey, the impact from maintenance on construction steel this week was 1.262 million mt, down 57,000 mt WoW. EAF steel mills experienced intensified profit losses, with some reducing their operating hours or halting production for maintenance. Overall, the reduction in output from EAF steel mills was lower than the increase from blast furnace steel mills, resulting in a slight increase in construction steel supply. On the demand side, the current period is the traditional off-season for construction steel demand. The continuous rainy season in south China and high-temperature weather in the north have hindered construction activities at some sites. End-user downstream purchases are mainly driven by immediate needs, with overall demand showing relatively small fluctuations compared to the previous period. In summary, the overall performance of the fundamentals remained largely unchanged from the previous period, with the total inventory of construction steel continuing to decline, albeit with a narrower decline.

This week, the total rebar inventory was 5.1853 million mt, down 75,100 mt WoW, a decrease of 1.43% (previous value: -2.20%). Compared to the same period of the previous lunar year, it decreased by 2.1391 million mt, a YoY decline of 29.21% (previous value: -29.21%).

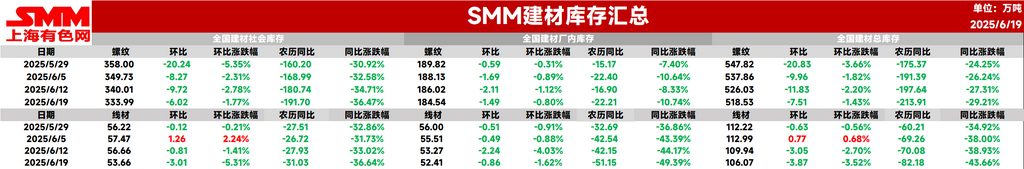

Table 1: Overview of Rebar Inventory

Data Source: SMM

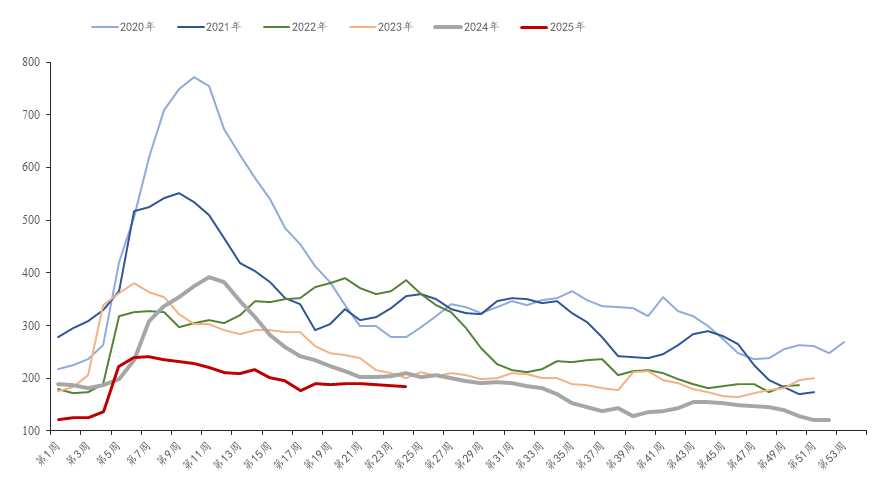

This week, the in-plant inventory of rebar was 1.8454 million mt, down 14,900 mt WoW, a decrease of 0.80% (previous value: -1.12%). Compared to the same period last year, it decreased by 222,100 mt, a YoY decline of 10.74% (previous value: -8.33%). This week, steel mills' direct supply situation was good, but market confidence was significantly insufficient, and agents' enthusiasm for purchasing was low, leading to a slight decrease in construction steel in-plant inventory.

Chart-1: Overview of Rebar Factory Warehouse Inventory Trends from 2020 to 2025

Data Source: SMM

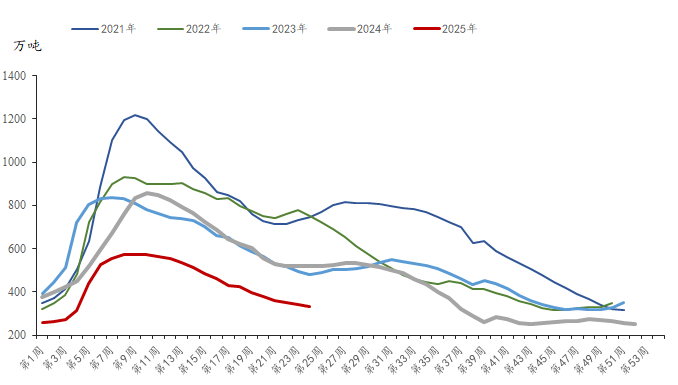

This week, the social inventory of rebar was 3.3399 million mt, down 60,200 mt WoW, a decrease of 1.77% (previous value: -2.78%). Compared to the same period last year, it decreased by 1.917 million mt, a YoY decline of 36.47% (previous value: -36.47%). This week, the spot price was in the doldrums, and the market trading atmosphere was average. Traders maintained a cautious attitude towards the future market, mostly maintaining low inventory stockpiling levels. Meanwhile, end-user downstream purchases remained mainly driven by immediate needs, resulting in a slight decrease in the overall social inventory of construction steel.

Chart-2: Overview of Rebar Social Inventory Trends from 2021 to 2025

Data Source: SMM

Looking ahead, on the supply side, the profits of blast furnace and EAF steel mills are currently in a state of divergence. Blast furnace steel mills still have profit margins in production, making it difficult to reduce their production enthusiasm. EAF steel mills, constrained by difficulties in collecting steel scrap and poor profits, mostly maintain production levels at flat and valley electricity rates, with limited room for increasing operating hours in the future. Overall, supply pressure still exists. Demand side, rainy weather persists in south China and high temperatures continue in the north, which may continue to affect the progress of downstream construction. Terminal purchases will still be dominated by rigid demand. It is expected that it will be difficult to continue reducing the total inventory of building materials next week, and a slight accumulation may occur.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)